A quiet shift has just changed the property finance game—and most people haven’t noticed yet.

In April 2025, new research from CoreData (commissioned by the FBAA) revealed the true impact of a proposed reduction in the mortgage serviceability buffer rate from 3.0% to 2.5%. At first glance, half a percent might not seem like a big deal.

But here’s the truth:

This subtle policy shift could unlock an additional $276 billion in borrowing capacity across the country. It could also bring nearly 400,000 new buyers—mostly younger Australians—into the market. And if you’re already a property investor or planning to become one… this matters more than you think.

Let’s break down what’s happening, what it means, and how you can stay ahead.

First, what is the serviceability buffer?

The serviceability buffer is a financial cushion lenders are required to use when assessing your ability to repay a home loan. Set by the Australian Prudential Regulation Authority (APRA), it ensures borrowers can still manage repayments even if interest rates rise in future.

For years, this buffer has sat at 3%—meaning if your interest rate is 5%, banks assess you as if you were paying 8%. This makes borrowing harder, especially for those near the qualification threshold.

Why the reduction to 2.5% is a gamechanger

Reducing the buffer by just 0.5% might sound small, but the data shows it lowers income thresholds and broadens loan eligibility dramatically.

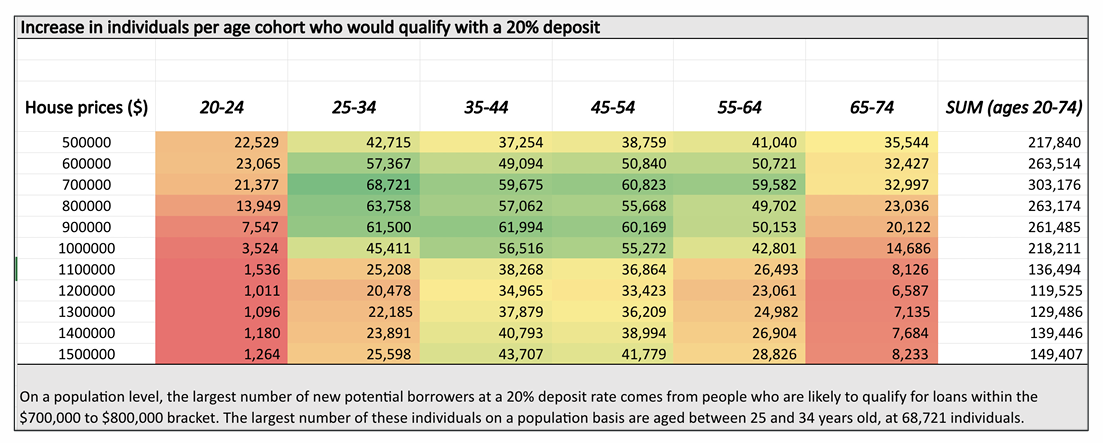

- 269,862 more Australians would qualify for a median-priced home loan

- Borrowing capacity increases by 5% across the board

- That’s an average of $18,800 more available to the typical borrower

- The biggest winners? Young professionals aged 25–34 and those applying for loans over $1.5 million

This isn’t just about first home buyers—this affects investors too, especially those looking to refinance, scale or leverage equity for their next purchase.

The new battlefield: $700K–$800K price range

Modelling shows the $700k–$800k price bracket is where borrowing capacity will increase the most. With this shift, many who were just below approval thresholds will now qualify—particularly those with smaller deposits (think 5% to 10%).

That means more offers, more buyers at auctions, and tighter margins for negotiation.

And if you’re aiming above that range—say $1M to $1.5M—this change still works in your favour. You’ll find fewer hurdles, more competitive lending offers, and potentially, a faster path to expanding your portfolio.

Why timing matters more than ever

There’s a window here. But it won’t stay open forever.

History shows us that when lending becomes easier, demand rises—and so do property prices. We saw this in Canada in 2018. And we’re already seeing early signals here in Australia.

So while the buffer cut helps more people enter the market, it also intensifies competition. If you have capital ready or are sitting on equity, this is your cue to act.

What this means for current borrowers

If you’ve been stuck paying higher interest because your refinance application was declined due to serviceability issues—this may be your way out.

Roughly 1% of Australian loans are refinanced monthly, and this policy could free many ‘mortgage prisoners’ locked into loyalty tax or suboptimal terms. With the buffer reduction, lenders may now say “yes” where they previously said “no.”

What to do next

At Lagos Financial, we don’t just watch the market—we help you move with it. Whether you’re looking to buy, refinance, or build a strategy for expansion, this shift could be the leverage you’ve been waiting for.

Want to find out how much more you can borrow now?

Book a complimentary assessment with our team—we’ll run the numbers and help you plan your next move with clarity and confidence.

What to do next

The buffer rate change is more than just a technical tweak—it’s a signal. A signal that lending conditions are loosening, and opportunity is knocking for strategic investors.

The only question is: will you take action before the crowd does?