Services

Get help finding the perfect property to invest in.

Have access to a wide range of properties, no matter where you’re looking.

Work with an experienced team who knows what they’re doing.

Invest in properties that will give you a positive cashflow.

Feel confident knowing that you have a team of experts behind you.

How we can help you

Our clients are generally new, or first-time investors, or families looking to invest in property and know they need trusted advisers to become part of their personal finance team and help them to build generational wealth through property investment.

They want to feel confident knowing that they have a team of experts behind them, and know that their time is precious so want to have the right support in place to create their dreams.

Our clients are often young professionals and ambitious families, leading busy lives but want to make the most of their incomes, to support their children in the future or to lead freedom-based lifestyles through passive income opportunities. They want to invest in properties that will give their family a bright future and wants to partner with a team of specialists who add value.

If this sounds like you, let’s start your financial journey today…

Personal

Personal Loans

Car Loans

Debt Consolidation

SMSF Property Loans (Investor and Owner Occupier)

Refinance

Commercial

Full Doc Commercial Property Loan (Investment and Owner Occupier)

Lease Doc Property Loan (Investment only)

Development Finance (Land Banking, Subdivision)

Personal Loans for Business Purposes

Residential

Home loans

First Home Buyers

Residential investment loans

Equity release

Construction Loans

Business

Business Loans (Term loans, Working Capital, Overdrafts, Debtor/Invoice Finance)

Asset Finance for Vehicles (Chattel Mortgages)

Equipment Finance (Finance Lease, Chattel Mortgage, Commercial Hire Purchase)

Case Study

How financial planning plays a vital role in wealth creation

The before…

The clients, a couple, Partner 1 and Partner 2, both professionals, approached a financial planner I work closely with, with the aim of building a passive income stream and expanding their property portfolio. They wanted to ensure that if one or both could not work, they would not have to sell their properties to fund mortgage payments or lifestyle expenses.

The couple was relatively young, with Partner 1 being 29 years old and Partner 2 being 32 years old. Partner 1 earned an annual income of $108,140, while Partner 2 earned $167,860.83 annually. They had living expenses of $48,000 per annum.

The assets…

In terms of assets, Partner 1 owned a motor vehicle worth $10,000, had current savings of $110,000, $1,000 in Crypto, and an investment property worth $577,000. Partner 2 owned a motor vehicle worth $18,000, had current savings of $62,000, $14,000 in Crypto, household contents worth $2,500, and a primary residence worth $470,000. They jointly owned household contents worth $30,000 and an investment property worth $550,000.

The liabilities…

The clients’ liabilities included an investment property mortgage of $415,000 for Partner 1, a credit card debt of $1,000 for Partner 1, a primary residence mortgage of $385,266 for Partner 2, an additional loan of $3,682 for Partner 2, and a joint investment property mortgage of $494,517.

Partner 1 had a superannuation balance of $93,503.63, while Partner 2 had a balance of $97,003.13. The clients’ identified goals were to diversify their current property portfolio, protect their wealth beyond the event of being unable to work, review superannuation to grow more wealth, reduce costs, and set up for future strategies, such as having more property in their Super.

Plan of action…

The financial planner advised that the clients needed protection of human capital, spouse, and wealth. They determined the amount of insurance needed by each client and tailored it to their needs, which included setting up life insurance, Total and Permanent Disability (TPD) protection, and trauma protection.

The financial planner also set up Income Protection for both clients. In the event that either partner could not work due to illness or injury, they would receive 70% of their income. This measure provided them with peace of mind knowing they could still maintain their living standards.

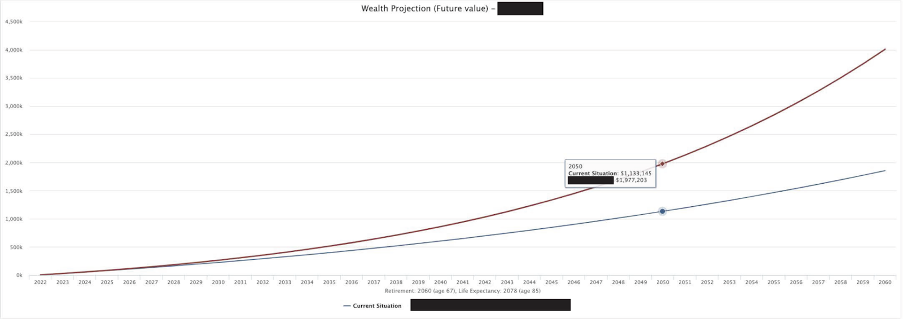

In addition to the insurance, the financial planner also reviewed the clients’ superannuation and helped them with Superannuation Nominations set up. They increased Partner 1’s super balance by $471,000 and Partner 2’s super balance by $764,000. This would go a long way in helping them achieve their financial goals and set them up for future wealth creation.

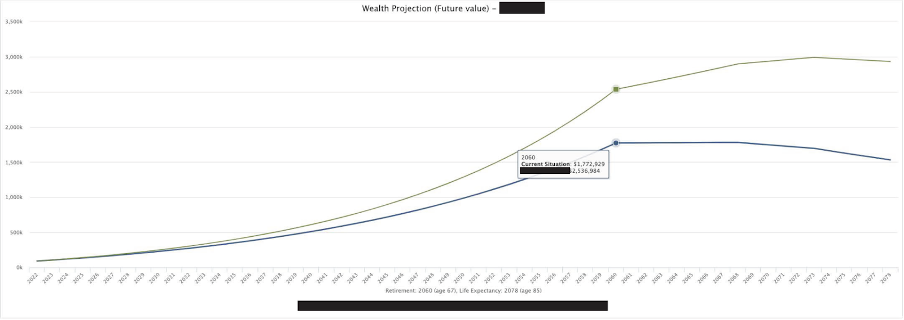

Partner 1

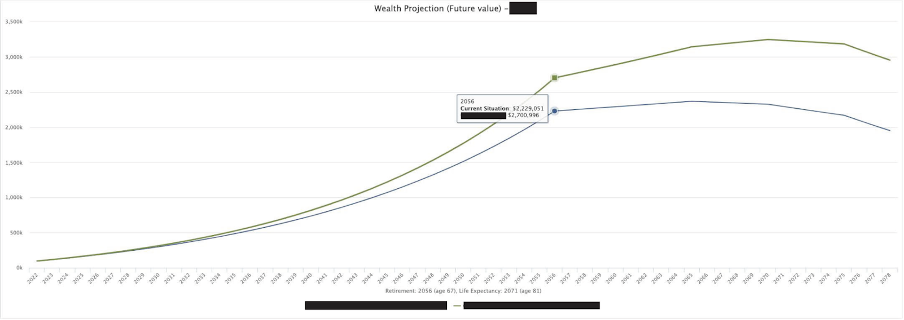

Partner 2

Notably, the contributions to the investment account would not affect their ability to borrow for more properties as desired. The investment account would help them to structure their cash flow effectively by understanding their spending patterns and ensuring that they are put to good use.

Investment Account Projections

The after…

Apart from the tangible financial benefits this approach had for this couple, the intangible benefits were considerable too.

The clients’ financial satisfaction (and confidence) increased as they learned about alternative and diversified investment opportunities.

Their peace of mind knowing that if the unfortunate were to happen to their health, they could still maintain their living standards (this is priceless in my opinion!)

A new cash flow structure has given them ways to expand their lifestyle, understanding what they spend and how they can put their earnings to better use.

Having a financial team around them is like hiring the best trainer in the gym – someone who knows what they’re doing and walks their talk. This couple now has a complete financial team on their side – knowing who does what, and having their best interests at heart.

(Other professionals we can refer clients to as needed include accountant, commercial and estate lawyers and more).

Couple are now on the same page with investment and cash flow allocation.