Owning a rental property in Australia comes with its fair share of responsibilities. While regular upkeep is important, landlords also have a legal obligation to provide a safe environment for their tenants.

However, even with the best efforts to maintain the property, unforeseen accidents can still occur. When they do, landlords may find themselves facing significant compensation claims. That’s where public liability insurance steps in, offering essential financial protection and peace of mind.

What is Public Liability Insurance for Landlords?

Public liability insurance for landlords protects you financially if a tenant, visitor, or even a contractor is injured or their property is damaged while at your rental property—and you’re found legally responsible. Without it, you could be on the hook for significant legal costs and compensation payments.

Imagine a tenant tripping on a loose floorboard and breaking their arm or a visitor’s car being damaged by a falling tree branch on your property. These incidents could result in costly legal claims, which could devastate your finances if you don’t have the right cover in place. Policies generally provide between $5 million to $20 million in coverage, offering you peace of mind.

Why Do You Need Public Liability Insurance as a Landlord?

Accidents can happen anywhere, even in well-maintained homes, and without public liability insurance, the financial fallout could be severe. As a landlord, you are legally responsible for maintaining a safe property for your tenants. Failure to meet this obligation can result in negligence claims and compensation demands.

While there’s no legal requirement for landlords to have public liability insurance, it’s highly recommended—especially if you’re renting out your property through a real estate agency or including it in a rental agreement. Legal costs and potential payouts from accidents can easily escalate, making it risky to go without proper coverage.

Home and Contents Insurance Isn’t Enough

A common misconception among property owners is that home and contents insurance covers everything—including public liability. Unfortunately, that’s not the case. These policies are designed for owner-occupiers, not rental properties. Without a specific landlord insurance policy that includes public liability insurance, you won’t be covered if an incident happens on your rental property.

In fact, even if you’re just renting out a room in your home, it’s essential to notify your insurer and get the appropriate landlord coverage to avoid any issues down the track.

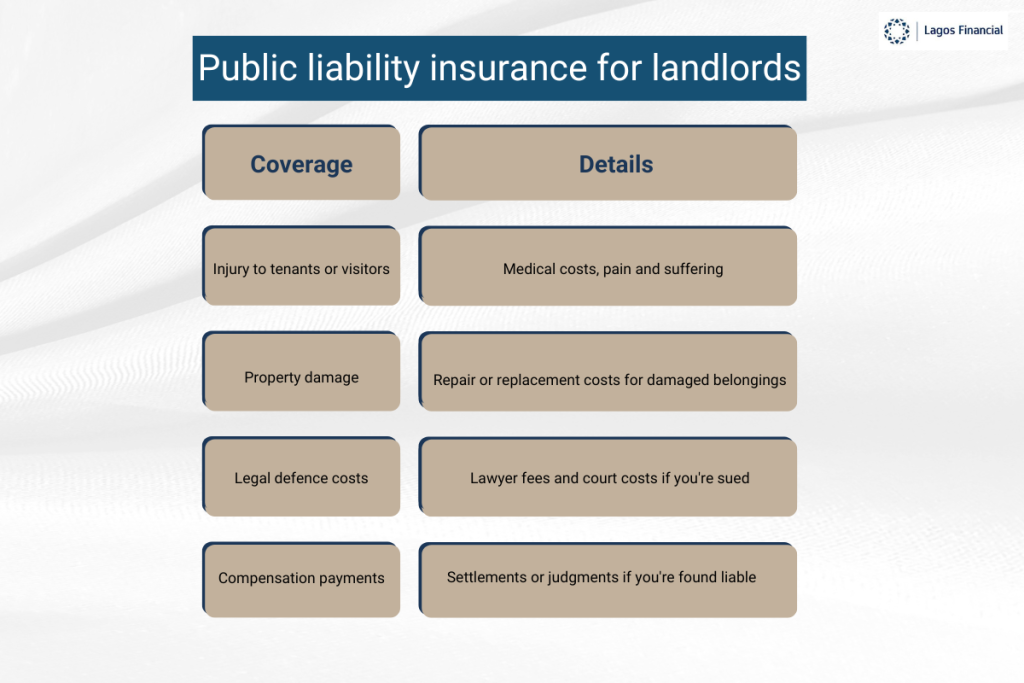

What Does Public Liability Insurance Cover?

However, policies usually won’t cover intentional damage, criminal activity, or damage to your own property, so it’s important to read the fine print and exclusions carefully before purchasing a policy.

The Risks of Not Having the Right Insurance

Let’s say you’re leasing out a spare room and a tenant gets injured because of a loose step you haven’t repaired. If you don’t have the right insurance, you could face significant legal and compensation costs, especially if your home and contents policy doesn’t cover rental situations. Failing to disclose this to your insurer could void your existing policy, leaving you vulnerable to paying out of pocket for legal fees and potential damages.

It’s a small price to pay for security. A small premium today could save you from financial ruin tomorrow.

Where Do You Get Public Liability Insurance?

Many landlord insurance policies include public liability insurance, alongside other protections like building cover, rent default protection, and more. These bundled policies are often the most convenient and cost-effective options for landlords. However, if you prefer, you can also purchase a stand-alone public liability insurance policy.

When looking for a policy, premiums will vary based on factors such as:

- The amount of coverage you need

- The type and location of your rental property

- Your claims history

It’s always a good idea to speak with an insurance broker who can guide you through the best options based on your specific circumstances.

Key Takeaways

- Public liability insurance is essential for landlords to protect against injury and damage claims from tenants and visitors.

- Home and contents insurance is not enough—you need a specialised landlord policy.

- Not having the right insurance could lead to financial disaster if you’re sued.

- Policies typically cover injury, property damage, legal costs, and compensation payments.

- Landlord insurance bundles are often the most convenient way to get comprehensive coverage.

- Every landlord’s situation is different, so speak with an insurance broker to find the right coverage at the best price.

Final Thoughts

As a landlord, you’ve got enough on your plate without worrying about the financial consequences of an accident on your property. Public liability insurance offers protection against the unexpected, giving you peace of mind. Whether you’re leasing out an entire property or just a spare room, having the right insurance could save you from a costly legal battle down the line.

If you’re unsure about your coverage or want to ensure you’re fully protected, it’s worth talking to an insurance broker who can tailor a policy to your specific needs. After all, the safety of your tenants—and your finances—should always be a priority.

Need Expert Advice on Protecting Your Property?

At Lagos Financial, we’re here to help you protect your investment with the right mortgage advice. Let’s ensure your property is set up for success and minimise any financial risks.