In a significant move, the Victorian Government announced in the 2023-24 Budget that it will abolish stamp duty on commercial and industrial properties, replacing it with a more efficient annual tax based on unimproved land value. This reform, termed the ‘Commercial and Industrial Property Tax,’ aims to boost business growth and economic productivity.

Why This Property Tax Reform Matters

Stamp duty, a substantial cost for property buyers, has long been a deterrent to investment, expansion, and relocation of businesses. By removing this upfront cost, businesses are expected to invest more in their operations, infrastructure, and expansion, thus driving economic growth across Victoria.

This reform aligns with recommendations from several major reviews, including the Henry Tax Review and the Productivity Commission.

Key Benefits of Property Tax Reform

- Encourages Business Expansion: Businesses can now choose locations based on strategic needs rather than cost considerations, enabling them to be closer to customers or workforce hubs.

- Stimulates Investment: Lower upfront costs mean businesses have more capital to invest in building and infrastructure.

- Promotes Efficient Land Use: Encourages the optimal use of commercial and industrial land, driving better resource allocation.

For detailed benefits of the reform, refer to the Victorian Government’s reform information page.

The Reform in 5 Steps

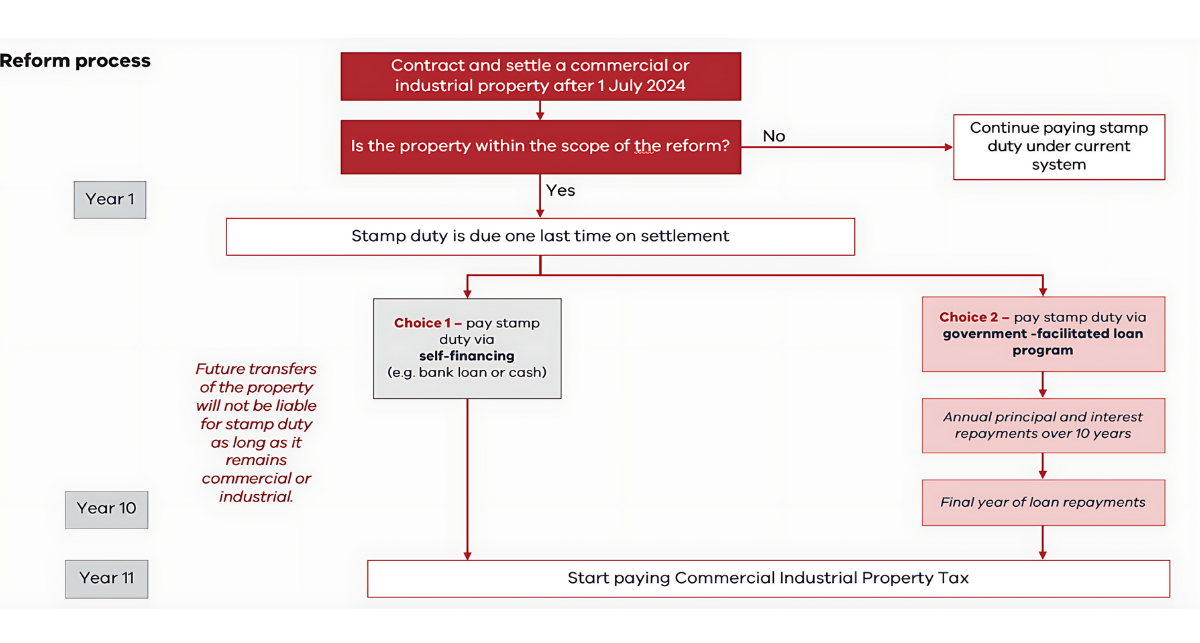

- Commencement on 1 July 2024: The reform begins, affecting only properties transacted from this date onward. Owners of existing commercial and industrial properties will not be directly impacted unless 50% or more of their property is sold.

- Transition Period Begins at Settlement: For properties contracted on or after 1 July 2024, the purchaser can either pay the final stamp duty upfront or opt for a government-facilitated transition loan, which spreads the cost over ten years.

- No Future Stamp Duty: Once a property enters the new system, it will be exempt from stamp duty on future transactions within the ten-year transition period, provided it continues to be used for commercial or industrial purposes.

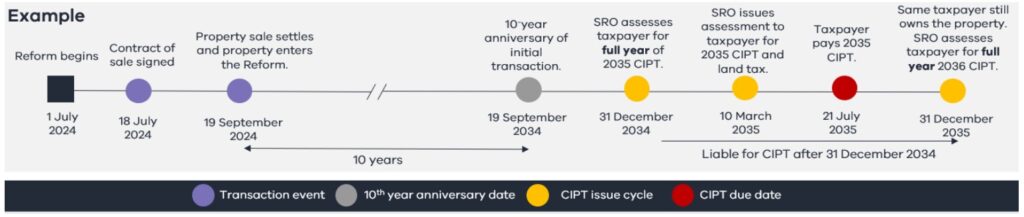

- Annual Tax Starts After 10 Years: The new annual tax will commence ten years after the initial transaction, regardless of whether the property has been sold again. This tax will be a flat 1% of the unimproved land value.

- Continuous Use Clause: As long as the property is used for commercial or industrial purposes, no further stamp duty will be applicable. The annual tax will continue to apply to all future owners of the property.

How the New Tax System Works

Starting 1 July 2024, commercial and industrial property transactions will no longer incur stamp duty. Instead, these properties will be subject to the new annual Commercial and Industrial Property Tax, which is set at 1% of the unimproved land value. This tax will be payable ten years after the property’s last stamp duty payment.

Transitioning to the New System

To ease the transition, the Government offers a facilitated loan option. Eligible purchasers can choose to finance the final stamp duty payment over ten years, freeing up capital for immediate business use.

This loan will be available to Australian citizens, permanent residents, and businesses for properties valued up to $30 million. Detailed loan terms and conditions will be available in 2024.

Special Considerations

- Mixed-Use Properties: Properties with both qualifying and non-qualifying uses will be assessed based on the primary use. For example, a building with a shop and a residence will be taxed according to its primary use.

- Change of Use: If a property’s use changes from commercial/industrial to non-qualifying (e.g., residential), it will no longer be liable for the new tax but will incur change-of-use duty.

- Exemptions: The reform does not apply to properties used for residential, primary production, community services, sport, heritage, or those purchased before 1 July 2024 unless 50% or more of the property is transacted after this date.

For more details on exemptions and how mixed-use properties are treated, visit the State Revenue Office website.

Case Studies: Practical Examples

- New Purchase Example: Emma buys a commercial property on 25 September 2024. She can choose to pay stamp duty upfront or opt for a transition loan. The new annual tax will commence ten years later.

- Subsequent Purchase Example: Minh buys a retail premise in October 2030, which had already entered the reform. He pays no stamp duty and starts paying the annual tax from 2036.

Conclusion

This property tax reform represents a significant shift in how commercial and industrial properties are taxed in Victoria. By removing the upfront cost of stamp duty, businesses are encouraged to invest more freely, fostering economic growth and job creation.

For property investors and business owners, understanding these changes is crucial for making informed decisions. For further enquiries on the Commercial and Industrial Property Tax Reform, please contact information@dtf.vic.gov.au.